Uganda Rise to Middle-Income Status as GDP Reaches $61 Billion

National Budget: President Yoweri Kaguta Museveni has underscored Uganda’s remarkable economic progress, noting that the country’s Gross Domestic Product (GDP) has expanded from $3.9 billion in 1986 to $61 billion by exchange rates and $170.4 billion by Purchasing Power Parity (PPP), supported by a population of 46 million.

This substantial growth has elevated Uganda from a Least Developed Country (LDC) to a lower middle-income status.

President Museveni pointed to key economic fundamentals driving this transition, including GDP growth, price and currency stability, job creation, increased export earnings, and rising foreign direct investment (FDI) inflows.

He emphasized the importance of understanding these indicators to grasp the broader economic landscape.

He also reaffirmed the government’s commitment to building a resilient, stable, transformative, and competitive economy.

Highlighting fiscal milestones, the President noted that Uganda’s economy is projected to expand to Shs 226.3 trillion (approximately USD 61.3 billion) in the 2024/25 financial year, up from Shs 203.7 trillion (USD 53.9 billion) in FY 2023/24.

“The economic fundamentals, GDP growth, price stability, currency stability, jobs, exports, and FDI are all in good shape,” President Museveni said, adding that Uganda has now graduated from LDC status to a lower middle-income country.

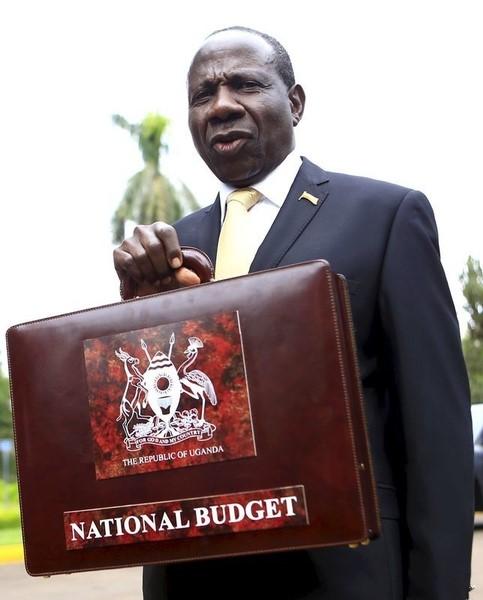

In his budget speech on June 12, Finance Minister Matia Kasaija echoed the President’s sentiments, stating that Uganda is among the fastest-growing economies globally and is projected to become the fastest-growing by 2031, according to the Harvard Growth Lab.

He attributed this performance to the unique economic ideology championed by President Museveni, based on four pillars: socio-economic transformation, patriotism, Pan-Africanism, and democracy.

Kasaija highlighted that the economy has more than tripled from Shs 64.8 trillion (USD 27.9 billion) in FY 2010/11 to Shs 226.3 trillion (USD 61.3 billion) in FY 2024/25. He also noted that Uganda met the criteria for LDC graduation in March 2024.

Life expectancy has improved significantly, rising to 68.2 years in FY 2023/24 from 63.3 years in 2010/11 and 50.4 years in 2002.

This improvement is attributed to better access to health services, successful immunization campaigns, and reduced child mortality.

Additionally, 91% of Uganda’s population now lives within a 5-kilometre radius of a health facility, up from 80% in FY 2010/11. About 81% of parishes are now served by government-aided schools.

The Finance Minister credited this impressive economic performance to deliberate government investment in wealth creation initiatives, guided by the President’s leadership.

“His Excellency the President has set the tone and provided the leadership and direction necessary for this transformation,” Kasaija stated.

He noted that over Shs 9 trillion has been invested in key wealth creation programs over the past decade. These include:

- Uganda Development Bank – Shs 1.45 trillion

- Parish Development Model – Shs 3.3 trillion (by end of FY 2024/25)

- Emyooga – Shs 553 billion

- Youth Livelihood Programme – Shs 207.95 billion

- Small Business Recovery Fund – Shs 100 billion

- Agricultural Credit Facility – Shs 495 billion

- Youth Venture Capital Fund – Shs 12.5 billion

- Uganda Women Entrepreneurship Programme – Shs 168 billion

- INVITE Project – Shs 800 billion

- GROW Project – Shs 824 billion

- Uganda Development Corporation – Shs 1.2 trillion

For the 2025/26 financial year, the total resource envelope is projected at Shs 72.38 trillion. The breakdown is as follows:

- Domestic revenue: Shs 37.55 trillion

- Tax revenue: Shs 33.94 trillion

- Non-tax revenue: Shs 3.28 trillion

- Local Government revenue: Shs 328.6 billion

- Domestic borrowing: Shs 11.38 trillion

- Refinancing of maturing domestic debt: Shs 10.03 trillion

- Grants and external budget support: Shs 2.08 trillion

- External financing for projects: Shs 11.33 trillion (including Shs 2.8 trillion in grants)

To finance this budget, the government will implement several strategies:

- Enhance tax administration to raise an additional Shs 1.89 trillion.

- Introduce new tax measures expected to yield Shs 538.6 billion.

- Rationalize tax exemptions to remove inefficient ones.

- Repurpose budgetary resources toward high-impact areas, aligned with the Tenfold Growth Strategy.

- Increase concessional borrowing from institutions like the World Bank, IMF, AfDB, IsDB, and BADEA.

- Explore alternative financing sources, including Public-Private Partnerships, climate finance, private equity, and bonds such as Sukuk, Panda, and diaspora bonds.